My Friday Favourite this week is PensionBee – Combine Your Pensions and Manage Them Online.

What is it?

PensionBee is a service that manages your pension online.

How can it help me?

If you’ve had a number of jobs, then you may have a number of separate work pensions. These pensions being in different pension pots makes them difficult to monitor and manage.

PensionBee allows you to quickly combine all these old pension pots into a single pension that is easy to manage.

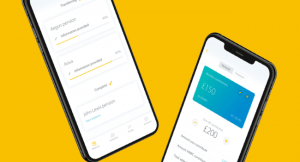

If you want to keep track of your pension performance, then your current pension provider probably doesn’t make this too easy. You typically have to wait for an annual printed statement or telephone the pension provider for an update. PensionBee is fully managed online so you can see the current performance of your pension at any moment, via the app or website.

Even if you’re self-employed with irregular income, then you’ll know the pain of trying to make regular additional contributions to your existing Pension. It can be a laborious and time-consuming process. PensionBee allows you to quickly and easily set up and modify regular contributions to your Pension, as well as making additional payments and seeing the resulting funds in your pension pot at any time.

In short, PensionBee gives you one simple pension and one clear balance that you can check any time online. Everything is designed to give you total peace of mind.

I recently moved my Pension from a traditional provider across to PensionBee and it was a breeze. The PensionBee customer service is excellent and they make the whole process very simple.

If you’re a fan of the challenger banks like Monzo – The new UK-based Bank of the Future or Starling Bank, then you’ll know the power that these new FinTech companies bring to personal finance. PensionBee is causing the same disruption in the Pension industry.

Please be aware I’m not a financial expert and don’t pretend to be one on the Internet! I’d recommend reading the independent PensionBee review from MoneytotheMasses for more details, and seek out professional advice if necessary.

How much does it cost?

PensionBee does not charge any fees to move your pensions to them.

PensionBee’s ongoing charges range from 0.5% to 0.95% a year depending on the pension plan you choose and how much you invest.

Visit the PensionBee fees page for a full overview.

How can I get it?

To get started, visit the PensionBee homepage.

You can also visit the PensionBee Facebook page, follow @PensionBee on Twitter, or follow PensionBee on LinkedIn.

PensionBee have apps for Android and iOS.

Risk warning

As always with investments, your capital is at risk. The value of your investment can go down as well as up, and you may get back less than you invest. This information should not be regarded as financial advice. I’m not a financial advisor and don’t play one on the Internet!

Comments