Late client payments is a common challenge for IT Solution and Managed Service Providers (MSP’s).

Cash flow is important in any small business, but many IT businesses are reluctant to chase clients who have overdue bills for fear of damaging their relationship. I believe that any client who is consistently overdue with payments has already damaged the relationship.

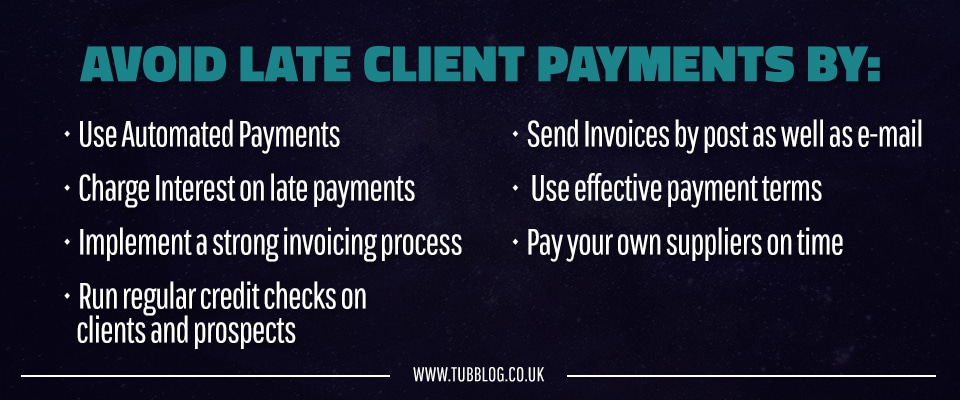

The good news though is that there are plenty of ways to avoid late client payments and I share 7 of them here.

Use automated payments

Use automated payments

I’ve already spoken about the value of using Direct Debit to simplify Managed Service billing within your IT business.

Any MSPs who are not charging their clients a month in advance for services are certainly missing a trick in my opinion, and those who are waiting for regular clients to manually pay invoices are opening themselves up to late payments.

Of course you can automate payments through Standing Orders, but over time this becomes unwieldy and inefficient. Direct Debit then becomes preferable.

For MSP’s, there are a few good UK Direct Debit providers I can recommend who allow you to take Direct Debits without the need to jump through the hoops the banks put in front of you.

For Break/Fix companies who regularly do work for clients, consider a service such as GoCardless to allow quick post-work billing.

Send invoices by post as well as e-mail

Send invoices by post as well as e-mail

Find out which of your clients prefer to be sent invoices via email, and which prefer to receive them by post.

When I owned an MSP, I worked with a number of clients who would receive an invoice via email and then print it out.

This may seem laborious to us technical sorts, but if your client is this way inclined, it’s in your interest to appreciate that while they may overlook emails, a printed invoice sent through the post has more of a chance of getting into that payments in-tray.

Run regular credit checks on clients and prospects

Run regular credit checks on clients and prospects

Services like DueDil offer a free and easy way to keep track of both clients and prospects, giving you early warning signs for those clients who are unable or unwilling to pay you on time.

Charge interest on late payments

Charge interest on late payments

In the UK, you’re legally entitled to charge interest under the late payment legislation.

Taking this route might damage your relationship with a client, but if they are persistent late payers it can be a firm sign that you’re taking later payments seriously.

Implement a strong invoicing process

Implement a strong invoicing process

A strong invoicing process is one that includes:-

Sending invoices out in a timely fashion on completion of work

Ensuring, and not assuming, invoices have been received by clients

Telephoning (not emailing) just before invoices are about to go overdue

Telephoning immediately when invoices do go overdue

Use effective payment terms

Use effective payment terms

Some businesses state “Due on receipt” on their invoices. I’ve rarely come across a client who pays attention to this.

Most clients will include paying an invoice in their next payment run, regardless of when the due date is.

Find out when those payment runs are made – typically it’s weekly but can be monthly.

So instead of “Due on receipt” include a “Due within 7 days” or better still, a specific date the invoice is due to more effectively remind clients to pay on time.

Pay your own suppliers on time

Pay your own suppliers on time

If you have a strong payment routine to pay your own suppliers in a timely fashion, then you’ll strengthen both your companies reputation and internal values towards payments.

It’s a much more compelling way to convey such values to clients as opposed to the, “Do as I say, not as I do” attitude.

Pay On Time has some useful tips on promoting this attitude to your clients and suppliers.

Conclusion

Conclusion

You probably started your IT business to help others, not chase overdue invoices.

By making sure you have a strong set of processes around how you bill your clients, you’ll educate them into paying you on time, and earn more respect professionally too.

You Might Also Be Interested In

What do Your MSP Invoices Look Like?

Using Direct Debit to Simplify Managed Service billing

Does Your MSP Keep Losing Business on Price?

Comments

6 thoughts on 7 tips to avoid late client payments

TIM LONG

8TH OCTOBER 2012 10:19:09

Some good advice there, Richard - most of which I have had to learn the hard way. Couple of things to add. PayPal has a reasonable system for collecting subscription based payments, I've recently started using it with my customers as a pilot study and its worked pretty well so far. The down side is that you have to have a button somewhere for the customer to click on, you can't set it up on their behalf. You can, however, change the amount if you need to. I've found that businesses tend to run their invoicing monthly rather than weekly, and they'll only pay an invoice if it is due in the month they are processing, so if you send a badly timed invoice with 30 days terms, then you can end up waiting 60 days. I used to mark all my invoices "7 days net" and almost without exception, everyone ignored it and assumed they had 30 days. All my managed services agreements state that the customer must use an automatic payment, but hardly any of them do. In the end, it comes down to the relationship with the customer. A couple of my current customers refuse to use automatic payments, but will actually ring me up and remind me to send them an invoice if I forget. Those are the customers I go the extra mile for.

TIM KNIBBS

9TH OCTOBER 2012 09:36:32

Hi Richard, Great, sound advice. We have found moving to direct debit collections actually really simple. You don't even have to run all of the direct debit process yourself - there are plenty of good direct debit agents out there that will help - this is the route we went down originally. We could technically run the direct debit process ourselves now but we find it really useful to have an experience agent to partner with.

DANIEL KLEINFELD

9TH OCTOBER 2012 22:20:00

An excellent post, and I agree with Tim's additions. Businesses, especially the larger ones, pay +30, in some cases even +60 days after they receive the invoice, and if you're a couple of days late, then you get to wait in line. There's not always a great deal you can do with the larger companies - if you want their business, you just need to adjust for the dip in income that you'll have the first couple of months of working for them. By the way, when we started looking around for a good invoicing tool, we couldn't find one. So we developed one - Traxmo. It's free, if you want to give it a go - http://traxmo.com.

RICHARD TUBB

11TH OCTOBER 2012 07:11:10

Daniel - thanks for the kind words. I think you're spot on when it comes to dealing with larger businesses who have no flexibility (or some might say, bully smaller companies) with payment times. Personally, I used to put my rates up slightly to compensate for the fact they chose not to pay in a timely fashion.

RICHARD TUBB

11TH OCTOBER 2012 07:12:38

Tim - appreciate the feedback! I'd agree - using a direct debit broker is the quickest and cheapest way to start collecting direct debits. A lot of people still think the bank is the only way to do this, but brokers are cheaper and more flexible too!

RICHARD TUBB

11TH OCTOBER 2012 07:13:11

Thanks Tim - I wasn't aware you could use PayPal in this way, definitely worth checking out!