Every Friday I share one of my favourite finds of the week — a website, tool or an app that has impressed me.

Every Friday I share one of my favourite finds of the week — a website, tool or an app that has impressed me.

My Friday Favourite this week is Yolt – Control Your Personal Finances.

What is it?

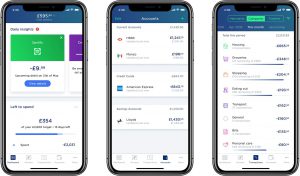

Yolt is an app that helps you track and control your personal finances.

How can it help me?

If you’re a small business owner, then I’ve written before about how to get to grip on your small business finances with a weekly financial report.

But one huge area that business owners overlook is tracking and controlling their personal finances.

To set business growth goals, you need to know how much you need to earn to cover your personal outgoings.

This is where Yolt can help you control your personal finances.

Yolt is an app that tracks your spending. It helps you set budgets and stay on track.

Yolt is the brainchild of ING Bank N.V.

To begin, you securely connect Yolt to your personal bank accounts, savings account, credit cards, investments and pensions.

Yolt has bank-level security measures, meaning your data is protected. If you’re comfortable using online banking, then you’ll be comfortable using Yolt.

Once your accounts are connected, Yolt then automatically keeps track of your spending and your saving. The app gives you suggestions to control your personal finances.

I personally use Yolt on a daily basis to take an at-a-glance look at all of the balances in my personal accounts. It instantly shows me how much money I have — and that I owe — without me having to open any other banking or credit card apps.

How much does it cost?

Yolt is free to use.

How can I get it?

Yolt is available for Android and iOS devices.

To install the Yolt app, visit the Yolt homepage.

You can also visit the Yolt Facebook page, follow @GetYolt on Twitter, or follow Yolt on LinkedIn.

Comments